Presidential 2022: inheritance taxes, why the candidates are taking up the subject

From Jean-Luc Mélenchon to Éric Zemmour, the candidates are multiplying their proposals on inheritance tax. A subject that is "fashionable" in this period of presidential campaign.

On average, one estate in two amounts to 170,000 euros and one in ten to more than 500,000 euros. However, many French people die without any capital. Therefore, according to François Lenglet, these measures on inheritance rights would only concern a "small number of French people, affecting a number of less than 1% of households".

However, according to a study carried out by the CAE, the Council for Economic Analysis, the nature of inheritance has changed in recent years, whether due to the extension of the lifespan or the part of the inherited heritage which has regained a preponderant place in society.

The return of inequalities

The share of inherited wealth in the heritage of the French has risen from 35 to 60% in 50 years. Inherited heritage therefore again occupies an important place, which risks causing the return of the unequal world of before 1914 where the share of inheritance was 85%.

To listen tooThe listeners have the floor"Face à Baba": "It was flying at the level of the daisies", comments Pascal Praud- 4m53sListen to Heart Walk Director Lena Minervino's interview on @WGANNews "A Healthy Conversation" yesterday, the last… https://t.co/8S0Dih574r

— AHAMaine Mon Tue 01 18:05:41 +0000 2021

In addition, before, the inheritance was a sum of money which "helped young people to to settle, to buy their accommodation, to build themselves": today, it has rather become a "complementary pension", analyzes François Lenglet. Indeed, with the lengthening of life, the average age of heirs has almost doubled, from 30 to 57 years, according to the CAE study.

Consequently, Emmanuel Macron wants "money to be more useful at the start of life and reinvested more in the economic circuit". He had launched in Marseilles last September the experimentation of a "young creator capital" for young entrepreneurs who would not have the means to embark on their project. This highly sensitive subject also revives the left/right divide.

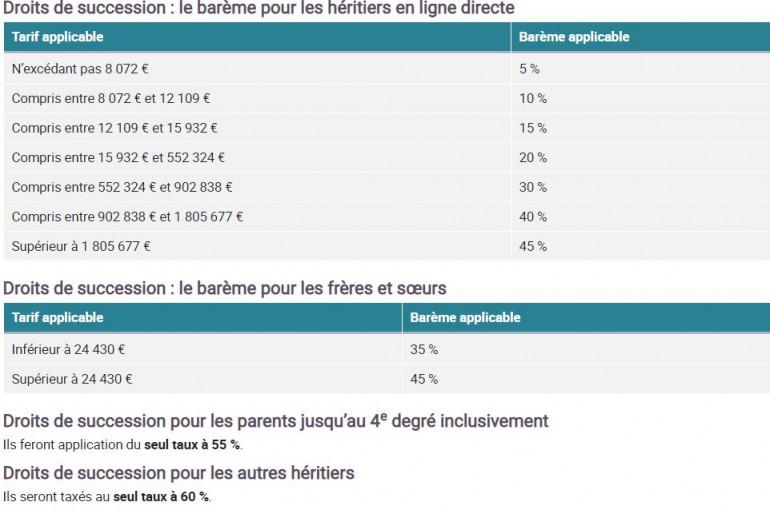

Tax-exempt donations on the right

On the right, candidates interested in tax-exempt donations, that is to say the amount of money you can give to your children without pay by right before the succession resulting from the death. Today, parents can transfer 260,000 euros to their children every fifteen years. For grandparents, the sum is 120,000 euros. The period of fifteen years was defined under the five-year term of François Hollande, while under Nicolas Sarkozy, it was fixed at six years. Marine Le Pen and Eric Zemmour want to lower it to ten years.

The National Rally candidate provides for a scale equal to 100,000 euros for grandparents and grandchildren, while the Reconquest candidate proposes to set the scale at 200,000 euros. Valérie Pécresse, candidate of the Republicans, wants to redefine over a period of six years "the transmission of heritage for a maximum amount of 100,000 euros for parents and grandparents and 50,000 euros for uncles, aunts and siblings". She intends to "remove inheritance tax for 95% of French people", therefore taking up one of the proposals which appeared in the program of Éric Ciotti, candidate for the primary of the right.

An overhaul of the scales on the left

On the left of the political spectrum, the candidates are also preparing to overhaul the scales and strengthen intergenerational solidarity. Yannick Jadot, the environmental candidate, intends to set the scale at 100,000 euros in a lifetime. Socialist candidate Anne Hidalgo wants to set a single allowance at 300,000 euros for everyone, regardless of family relationship, and set a tax rate of 60% for inheritances over two million euros. Fabien Roussel is in favor of "zero taxation" on inheritance tax "below 118,000 euros" regardless of the descendants. Above, a progressive tax would apply. The candidate of France Insoumise Jean-Luc Mélenchon wants "to take everything above 12 million euros of inheritance". This measure will concern one estate in 1,000. To weigh in on the debate, future candidate Emmanuel Macron said in his interview with readers of Le Parisien in early January that there were "things to improve". He wants to "promote popular transmission". According to Stanislas Guerini, general delegate of En Marche, the head of state does not want "to increase taxes and even not to make any losers". On LCI the Minister of the Economy Bruno Le Maire noted that "If you transmit to a nephew that you love very much, or to a niece, the taxation is extremely high, it is very penalizing" but he underlined that "the taxation remains reasonable " with regard to donations from grandparents and parents. Emmanuel Macron could, therefore, take up the proposals of Valérie Pécresse who wants to provide for a threshold of 50,000 euros of non-exempt donation "for uncles, aunts and siblings".

The editorial staff recommends To read also Presidential 2022 "Faced with Baba": the Zemmour / Mélenchon debate "flew at the level of the daisies", comments Pascal Praud Presidential 2022 succession taxes

10 Ways to Stay Safe When You Live Alone

Hotels, restaurants: tips paid by credit card will soon be tax-exempt

Will Belgian workers quit?

"I was a rot in the evening and a good cop in the morning": meeting with "Haurus", the thug policeman of the DGSI