Real estate investment: how to finance your SCPIs on credit

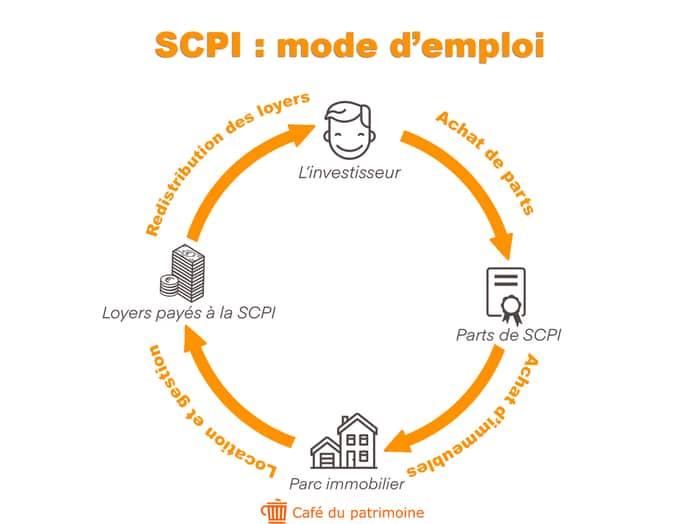

Subscribing shares of civil real estate investment companies (SCPI) is good. Investing in SCPIs using credit is even better. "Money costs 2%, the SCPI reports 5%," says Jean-Marc Peter, Managing Director of Sofidy and guest of the "Great Savings Rendez-vous" (Capital / Radio Patrimoine). But how can we obtain these funding, at historically low rates, and thus take advantage of the lever effect to maximize the profitability of your investment? Several solutions exist, according to Paul Bourdois, the co -founder of the France SCPI distribution platform interviewed in the “Report” sequence of our program. The expert recalls that a few years ago, an actor - Crédit Foncier - "financed in open architecture almost all SCPIs". But the latter ceased all its activities in 2019. Fortunately, other players took over: regional banks and consumer credit players.

>> Notre service - Pour vous aider à choisir les meilleures SCPI, bénéficiez de conseils d’experts gratuits grâce à notre partenaire

But how, concretely, obtain this funding? First of all, note that if these establishments give you a loan in most cases, "some actors (SCPI) are not elected because of their geographic exposure or the typology of their assets", warns Paul Bourdois. Thus, SCPIs entirely invested abroad or on assets deemed too risky may not have the lender's favors. Another factor to take into account, the financing method: mortgage or consumer credit? Everything will depend on your intermediary, a regional bank (Crédit Agricole, Banque Populaire - Caisse d'Épargne, Crédit Mutuel) will offer you a classic mortgage when a establishment specializing in consumer credit will offer you an affected credit. But do not be afraid to take out such a loan, advises Paul Bourdois: “Inevitably, a consumer credit rate is higher than a conventional credit rate. But when you look at a consumer credit, there is no brokerage fees, banking costs, management or compulsory insurance costs. And the answer is extremely fast, he lists. Over 15 years, consumer credit is more profitable than a mortgage. ” And this, even if the rate of the assigned consumer credit exceeds that of the classic loan of 1 point, at 2.2% against 1.2% or 1.3% respectively.

>> A lire aussi - SCPI : les nouveaux indicateurs de performance en vigueur en 2022

Obviously, to negotiate the best conditions, you must have competition played, for example by contacting brokers in credits.But not only, insists the co -founder of France SCPI: "It's always good to go see his bank and ask him to do better."And if you cannot find your happiness, do not hesitate to directly request a wealth management advisor (CGP).He has access to his own subscription channels, such as Sofidy Financing, a subsidiary of the management company SOFIDY which offers this clientele agreements with several regional banks and consumer credit institutes."With each shares to structure funding with their CGP," confirms Benjamin Le Baut, managing director of Alderan, also guest of the "Great Savings Rendez-vous".

>> A lire aussi - Pourquoi la fiscalité des SCPI investies à l’étranger est plus intéressante

10 Ways to Stay Safe When You Live Alone

Hotels, restaurants: tips paid by credit card will soon be tax-exempt

"I was a rot in the evening and a good cop in the morning": meeting with "Haurus", the thug policeman of the DGSI

Will Belgian workers quit?