3 tips for obtaining a mortgage when you are on fixed -term contracts

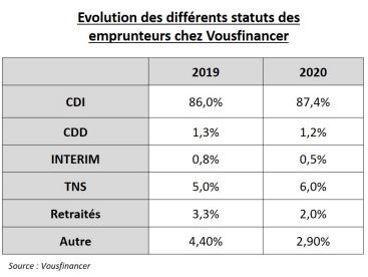

Despite the new expansion of the conditions for granting mortgage in connection with the recommendations of the HCSF (High Council for Financial Stability), the share of borrowers "excluding CDI" (indefinite contract), has further regressed in 2020.According to the broker youfinance, only 1.2 % of candidates for borrowing without permanent contracts (indefinite contract) managed to win a loan, against 1.3 % in 2019 and 1.7 % in 2017.This figure is far from the reality of the labor market in France since 87 % of hires is currently done on fixed -term contracts (fixed -term contract),.

Borrow for two, with a spouse on permanent contract

The best way to borrow when you are on fixed -term contracts is to do it for two, provided, however, that the spouse is on permanent contract.Thus 3.2 % of co-pruniers are on fixed-term contracts.Being on a short -term contract may however have a negative impact on the proposed interest rate, since the calculation of the borrowing capacity of spouses will be studied on the only wages of the spouse on permanent contract.

In addition, "in 2020, the health crisis affected a whole section of the economy - tourism, catering or event - a very employer of CDD, which makes this type of borrower weakened even more risky forBanks currently »Analysis Julie Bachet, Director General of YouFinancer.

I will your order from #Instacart Again.MRS.Margret, The Driver Did Not Understand How To Get To My Apartment An… https: // t.CO/FJGV8NFGDC

— ASTRO GIRL. Wed Apr 01 19:46:12 +0000 2020

Have stable income and seniority

In the current economic context, banks more than ever need to have visibility on the sustainability and regularity of income that will allow the borrower to reimburse his credit.This is why they are very attentive to the sector of activity, but also to the employability of the loan candidate, that is to say his ability to quickly find a job in his branch or his field of competence.Thus, "being in partial unemployment can be a brake for certain banks because the question arises of the future of the borrower when the government's support system ends" completes Julie Bachet.

Despite everything, some establishments still agree to take into account the full rate salary "if the borrower has been on fixed -term contract for several years and the accounts are well kept," explains Sandrine Allonier, director of studies to.

In addition to the salary, all sources of income are also taken into account.In the case of the borrower file of a solo mother, the bank can therefore take into account the alimony.Please note, "it will only be integrated if it has to last over a long time, in connection with the duration of a mortgage.If the separation takes place while children are young, less than 10 years for example, the pension can be decisive in the calculation of the debt rate.Conversely, if they are older, the bank will not count it, "explains Pierre Chapon, president of Pretto.

Contact your bank directly

According to youfinancer, business creators, intermittent entertainment and self-employed entrepreneurs are tied with fixed-term contracts are the most complex files to finance today.For these profiles, the best is often to contact the bank which holds professional accounts, because it knows better the profile of its client and the management it makes of its accounts and will therefore be more inclined to finance it.

Among the borrowers "excluding permanent contracts" recently financed, we can cite an intermittent of the show with great contribution and residual savings, an interim borrower with the contribution of costs and 3 years of seniority or a fixed -term contract married toA CDI with € 60,000 in income and € 30,000 in contribution.

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game