Free joint account: online banks comparison

Opening a joint account in an online bank helps reduce the management fees for this "common" account.Here are the conditions to obtain 2 free bank cards (1 for each cotitular) at Boursorama, Fortuneo, Hello Bank and Bforbank.

Info comparateurBanqueCartesgratuites inclusesDébitimmédiatDébitdifféréConditions d'accès à l'offreFosfo MastercardWithout income or savings condition

Voir l'offreFosfo MastercardDébit immédiatDébit différéConditions d'accès à l'offreWithout income or savings condition

Voir l'offreGold Mastercard2,700 of monthly income or 10,000 savings

Voir l'offreGold MastercardDébit immédiatDébit différéConditions d'accès à l'offre2,700 of monthly income or 10,000 savings

Voir l'offreWorld Elite Mastercard5,500 net monthly income

Voir l'offreWorld Elite MastercardDébit immédiatDébit différéConditions d'accès à l'offre5,500 net monthly income

Voir l'offreVisa à autorisation systématiqueWithout income conditions

Voir l'offreVisa à autorisation systématiqueDébit immédiatDébit différéConditions d'accès à l'offreWithout income conditions

Voir l'offreVisa à débit immédiat ou différé2,000 common net income

Voir l'offreVisa à débit immédiat ou différéDébit immédiatDébit différéConditions d'accès à l'offre2,000 common net income

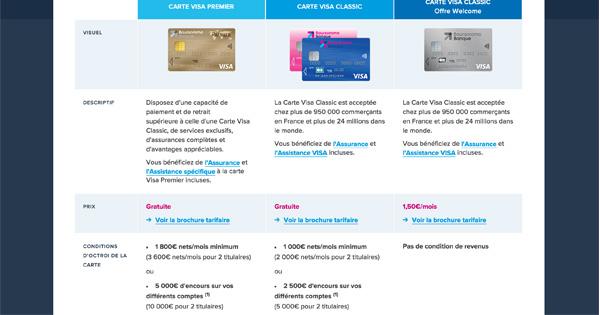

Voir l'offreVisa classique2,000 monthly income

Voir l'offreVisa classiqueDébit immédiatDébit différéConditions d'accès à l'offre2,000 monthly income

Voir l'offreVisa Premier2 400 de revenus mensuels ou 15 000 d'épargne chez BforBank + 2,000 monthly income

Voir l'offreVisa PremierDébit immédiatDébit différéConditions d'accès à l'offre2 400 de revenus mensuels ou 15 000 d'épargne chez BforBank + 2,000 monthly income

Voir l'offreVisa Welcome classiqueUnconditionally for new customers

50 outstanding for "already customers"

Voir l'offreVisa Welcome classiqueDébit immédiatDébit différéConditions d'accès à l'offreUnconditionally for new customers

50 outstanding for "already customers"

Voir l'offreVisa UltimImmediate debit card: without conditions for new customers;300 outstanding for "already customers"

Delayed debit card: 1,500 monthly credit flows or 3,000 euros in outstanding

Voir l'offreVisa UltimDébit immédiatDébit différéConditions d'accès à l'offreImmediate debit card: without conditions for new customers;300 outstanding for "already customers"

Delayed debit card: 1,500 monthly credit flows or 3,000 euros in outstanding

Voir l'offreWhat is a joint account?

Credit or rent matters, electricity or telephone bills, internet subscription, food shopping, expenses for children...To pay these charges (and others), many couples (married, PACS or in free union) choose to use a "common account".That is to say a attached deposit account, on which each of the two holders can carry out operations.The advantage of this solution is to clarify and facilitate the management of expenses between the two members of the couple.

5 tips for managing your money as a couple

Why open a joint account in an online bank?

Choosing an online bank for a joint account has many advantages.This type of establishments offers very limited fees for managing the common account.The 5 establishments present in the higher table allow us to obtain two bank cards for free (one for each co-holder of the account), to pay no account holding fees, to have lower overdraft, andto benefit most often from an absence of intervention commissions.

Some bank cards are issued free of charge without any conditions, others are however offered subject to justifying a certain level of income or savings (these conditions are mentioned in the table above).

Another advantage to open an joint account in an online bank rather than in a traditional establishment: if you are a new customer, the subscription sometimes allows you, depending on the online banks and the “promotions” of the moment, to obtain a bonuswelcome (which can climb up to 160 euros during certain commercial operations).

How to compare the online attached accounts?

To properly compare the offers of online banks in terms of the joint account, it is obviously necessary to go beyond the price (since this price is 0 euro in the 5 banks studied in the top of the top of the page)...First of all, you should determine the type of card you need.Do you want a standard card (Mastercard, Visa Classic) or a premium card (Gold Mastercard, Visa Premier)?Payment/withdrawal ceilings are higher with the second type of card, and more insurance/assistance.Do you prefer a balance control card (to avoid any overtaking)?Are you going to opt for an immediate speed or a delayed flow of your expenses by CB?Depending on the answers to these questions, you will direct yourself towards one or the other of the offers of online banks.

But it is also necessary that you return "in the nails" to be able to benefit from this or that card.Certain establishments set minimum monthly income conditions (without obligation to domicile them in the bank generally) or savings to hold on products in the establishment.In addition, it is sometimes also necessary to carry out x operations per month or quarter, or justify the credit flows over a certain period to be able to continue to benefit from the free card.

Other criteria to be taken into account, in particular as part of the family holidays: the insurance included with the chosen card, and the costs on withdrawals or payments in the euro zone and elsewhere in the world.You can find this information in the tables below.

| Banque | Type de carte | Assurancevoyage | Garantieneige et montagne | Frais médicauxà l'étranger | Responsabilité civileà l'étranger | Locationde véhicule | Vol ou dommagedu téléphone |

|---|---|---|---|---|---|---|---|

| Fosfo Mastercard | |||||||

| Gold Mastercard | |||||||

| World Elite Mastercard | |||||||

| Visa à autorisation systématique | |||||||

| Visa à débit immédiat ou différé | |||||||

| Visa classique | |||||||

| Visa Premier | |||||||

| Visa Welcome classique | |||||||

| Visa Ultim |

| Banque | Type de carte | Retraitsen zone | Paiementsen zone | Retraitshors zone | Paiementshors zone |

|---|---|---|---|---|---|

| Fosfo Mastercard | Gratuits | Gratuits | Gratuits | Gratuits | |

| Gold Mastercard | Gratuits | Gratuits | Gratuits | Gratuits | |

| World Elite Mastercard | Gratuits | Gratuits | Gratuits | Gratuits | |

| Visa à autorisation systématique | Gratuit | Gratuit | 1,5% | Gratuit | |

| Visa à débit immédiat ou différé | Gratuit | Gratuit | Gratuit | Gratuit | |

| Visa classique | Gratuit | Gratuit | 1,95% | 1,95% | |

| Visa Premier | Gratuit | Gratuit | 1,95% | 1,95% | |

| Visa Welcome classique | Gratuit | Gratuit | 1,69% à partir 2ème retrait | Gratuit | |

| Visa Ultim | Gratuit | Gratuit | 1,69% à partir 4ème retrait | Gratuit |

Fortuneo joint account: details

Fortuneo Banque allows you to open a joint account with one or two associated bank cards.If the Fosfo offer can only be taken out in an individual account, the other offers from online banking are accessible in an attachment.The account with classic mastercard is available subject to 2,400 of monthly net income or 5,000 of savings held at Fortuneo.The account with the Gold Mastercard is accessible by justifying 2,700 of monthly net income or 10,000 of savings previously held at Fortuneo.Big advantage of this card: withdrawals and payments are free worldwide.Mastercard Standard and Gold cards remain free as long as you carry out at least one card payment operation (excluding withdrawal to distribution) per month.Otherwise, the online bank invoices them respectively 3 and 9 per month.

In addition, Fortuneo allows you to open a joint account with a World Elite Mastercard (but the 2nd card will however be a Gold or a Classic). Pour bénéficier de cette offre, il faut justifier de 5,500 net monthly income et verser au moins 4 000 chaque mois sur le compte Fortuneo (à défaut, la carte sera facturée 50 par trimestre).

You can also with this joint account have a checkbook, make free transfers (punctual, permanent, instantaneous), deposit checks, benefit from virtual cards, make a mobile payment via Apple Pay and Google Pay...Beyond the joint account, Fortuneo provides its customers with savings solutions (booklet A, LDDS), investments (life insurance, scholarship) and credit (Immo and Cons Cons Cons).

Hello bank joint account: details

The hello one and hello prime offers are both declined as a joint account with the hello one duo and Hello Prime Duo offers.They also take up the same characteristics as individual formulas.The first, free, is accessible to everyone without income conditions.The second requires 2,000 euros in common net income and costs 8 euros per month.For this price, however, it incorporates two high -end cards, with a delayed or immediate debit, which allow you to make payments and withdrawals at no cost worldwide.

These hello bank joint accounts also give access to a checkbook, include the collection of checks but also of species (this is the only establishment in the top of the top of the page to allow it).They also make it possible to make transfers and set up samples.In addition, in terms of savings, online bank gives access to the whole catalog of its parent company BNP Paribas (booklet A, LDDS, LEP, PEL, CEL, Young book).It also offers its customers mortgage, consumer loan, life insurance contract and online scholarship offer.

Bforbank joint account: details

Two bank cards are free at BforBank as part of the opening of a joint account.The Classic Visa, with immediate debit only, is available free of charge subject to justifying 2,000 net income nets, while the first visa (with immediate or delayed debit) requires 2,400 nets per month of income.Their gratuitousness is subject to the realization of 3 operations per quarter (otherwise, the Classic visa will be billed 6 per quarter; 9 for the first).Another card is available as a joint account at BforBank, the prestigious infinite visa, but it is billed at 200 euros per year (and requires 6,000 net income).

Like its competitors, the online bank offers free account holding costs, allows free withdrawals to the euro zone and the implementation of transfers and samples, gives access to a checkbook, makes it possible for BforBank checks discounts also hasof a mortgage loan offer, consumption credit, life insurance or scholarship.

Boursorama joint account: details

At Boursorama Banque, you can choose between two offers with free bank cards: Welcome or Ultim.The Welcome card, with immediate debit and systematic authorization, is available for all new customers, without restrictions.Persons holding a stock market must justify 50 euros in outstanding their accounts to benefit from it.To obtain an Ultim card, the conditions differ according to the debit chosen but also according to whether you are already online bank customers on an individual or not.If the two cotturies of the joint account are new Boursorama customers, they can each obtain an Ultim with immediate debit without conditions;or a delayed debit ultim.If one of the two cotturies is already an individual Boursorama customer, the other co -owner will necessarily have to open an individual account too, before carrying out an additional joint account.And to subscribe to the latter, customers will then have to justify 300 outstanding outstanding accounts to obtain an immediate debit Visa;and 3,000 of credit flows over the last 90 days or 6,000 outstanding on its Boursorama Banque accounts for obtaining a ultitim card with delayed debit.

Note: the free of Welcome and Ultim cards is also conditioned in making at least one payment by CB each month (otherwise, they will be billed respectively 5 and 9 per month).

With both cards, payments are free worldwide.Regarding withdrawals outside the euro zone, the first of the month is free with Welcome, the first 3 of the month are with Ultim (beyond they are billed 1.69% of the amount of withdrawal).In addition, with these accounts, you have access to a checkbook, can make free instant transfers (up to 2,000), benefit from insurance means of payment included, can pay via Apple Pay or Google Pay

Note that you can subscribe to the Ultim Metal offer in a joint account but it is chargeable: 9.90 per month.

Beyond the bank account, Boursorama Banque offers savings booklets (booklet A, LDDS, PEL, CEL, account on booklet), a life insurance contract, an online scholarship offer, mortgage andconsumer loan.

Orange Bank et Monabanq, absentes du tableau

Our top of the top of the page is not incorporated Orange Bank since it is impossible to open a joint account in this establishment.Monabanq is not there either since online bank does not have free supply in its catalog.

How to open a joint account?

The procedure for opening a joint account is similar to that of an individual account.Thus, you will be asked to provide (electronically):

The contract is signed remotely, electronically.For the opening of the account to be effective, you will also usually have to make an initial payment by transfer or by check.The amount of this payment is different depending on the establishments and according to the offer subscribed.

How does the joint account work?

The joint account is based on mutual confidence between the two cotturies.Everyone can indeed pay by bank card or check, make cash withdrawals, set up samples or proceed to transfers (punctual or permanent)...

The use of a joint account is not without danger.The money deposited is presumed to belong to the two holders and, in the event of a debt or payment incidents, the two holders are jointly responsible.This means that the banking establishment can turn against one or the other, even if it is not at the origin of the incident.In the worst case, in the event of a unpaid check for example, the two spouses risk a banking ban on all of their accounts, even personal, even domiciled in another bank.

Based on confidence, the joint account can turn into a problem nest if one of the “skids” co -ownership and makes sumptuous expenses against the interest of the couple or the family.In this case, it is possible to transform the joint account into an undivided account.All operations then require the authorization of the two holders (emissions of checks, withdrawal authorizations, etc.).This in fact excludes payment by bank card, which must be returned.

As a couple, should we make "account aside"?

What title for the joint account?

Par défaut, le compte joint sera ouvert sous l'intitulé « Monsieur ou Madame»» (ou « Monsieuror monsieur»» ; ou « Madameor madame»») et dans ce cas, chacun peut disposer des moyens de paiement sans avoir besoin de l'autorisation de l'autre pour chaque dépense.

A l'inverse, avec un compte « Monsieur et Madame»» (compte indivis), chacun des titulaires doit obtenir l'accord de l'autre pour réaliser un paiement.Thus checks must be signed by the two spouses.

Joint account: What to do in case of separation?

Before arriving at a serious payment incident or in the event of separation, several options are available to you, depending on the situation:

Couple money to the bank, who has what?

What becomes of the joint account in the event of death?

During one of the two cotturies of a joint account, it is necessary to refer to the account of account signed with the bank to know what becomes the "common" account.In general, no blockage of the account is provided (unless the heirs have initiated an approach in this direction) and the joint account becomes an individual account.Its holder keeps the same RIB and the same bank card.On the other hand, the CB of the deceased must be returned.The checkbook, issued in the name of "M.or Mrs. "(or" M.or m.»». ; ou « Mmeor mme»»), peut continuer à être utilisé.

Furthermore, as the service-public site specifies.fr, « en cas de solde positif au jour du décès, la question de la détermination et du sort de la part appartenant au défunt fait partie du règlement général de la succession»».The surviving spouse must therefore not then carry out extravagant expenses that the heirs could contest at the time of the succession (since these expenses would have come to grew the amount of the inheritance).

On the other hand, for an undivided account, in the event of the death of one of the cotturies, the bank immediately the account.No more operation can be made (credit or debit).

Closing of the account of a joint: how does it work?

First of all, know that the bank has the right to close your joint account without explanation.On the other hand, she must respect a 2 -month notice between the moment when she informs you and the moment when the fence is effective.

If you want to close the joint account, you must send a bank termination request.The request (sent by registered mail with acknowledgment of receipt) must emanate from the two cotturies.For safety and to allow the latest operations to go well on the account (checks, non -modified samples, payments by CB), respect a notice period of at least 1 month and keep a sufficient provision on the account until the last moment.

See also:

© Moneyvox 2017-2022 / Marie Rialland / Page update / Rights reserved

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game