Gasoline outbreak. How is the selling price of fuel calculated?

Motorists want transparency at the pump. With an increase of 2 cents in a single week, the prices displayed near service stations have never been so high, even before the Yellow Vests they had not reached this record (between 1.55 € and 1. €90 per litre).

If the government is currently working on a fuel voucher, potentially distributed according to income conditions, some manufacturers have also committed to selling their fuel at cost price, but for Michel-Édouard Leclerc for example, "we must mobilize, State and companies private so as not to alter purchasing power in the months to come". According to him, “it was the state that had a lever [to lower prices] with the weight of taxes”.

Read alsoWhat could be announced in the face of soaring prices

A liter of shelled diesel

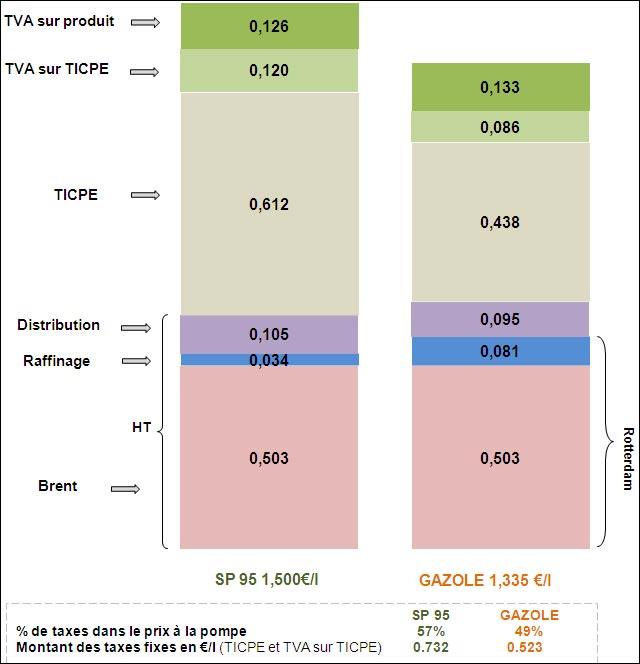

In a tweet, distributor U dissects the price of a liter of diesel displayed at €1.54. In detail, 55.84% of the price, or 86 cents, corresponds to the amount of taxes. Then 33.77% of the amount is equivalent to the price of fuel, i.e. 52 cents, to this is added 9.09% of distribution and transport costs (14 cents) and 1.30% of margin gross, i.e. only two euro cents per liter sold.

Read alsoCarrefour offers a discount of 5 euros for each tank of gas

These figures coincide with the information provided by the French giant Total Energies. The company explains how fuel prices are influenced by the price of crude oil and its processing. Thus, in addition to the raw material, the price of which varies regularly on international markets according to supply and demand, "other parameters also come into play, such as the geopolitical situation, climatic events, or even the health crisis, among others, and are likely to drive up or down oil prices.” Added to this is the cost of exploitation and development for the oil companies, the cost of refining the oil (before it becomes fuel), transport, storage, the operation of service stations, as well as the conversion of price per barrel (dollar) in euros.

Read alsoFuel sold at cost price at Leclerc until the end of October

Taxes represent 60% of the price

As manufacturers claim, taxes represent the most important part of the price of fuels. They vary greatly from one country to another and are largely responsible for price differences between countries. In France, the internal consumption tax on energy products (TICPE) and the value added tax (VAT fixed at 20%), make up nearly 60% of the final price at the pump. According to the Savoirdesenergies.org site, in 2018, taxes represented 61.4% of the amount of a liter of unleaded 95 and 58.6% of a liter of diesel. You know everything.

A question about what is making the news in Normandy or elsewhere? Ask it on PN & You, the editorial staff will answer you.

Continue reading on this/these topic(s):Oil and natural gas - Primary sector|Gasoline|France

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game