How long does it take to make a real estate purchase profitable?

How long to make the purchase of your principal residence profitable?

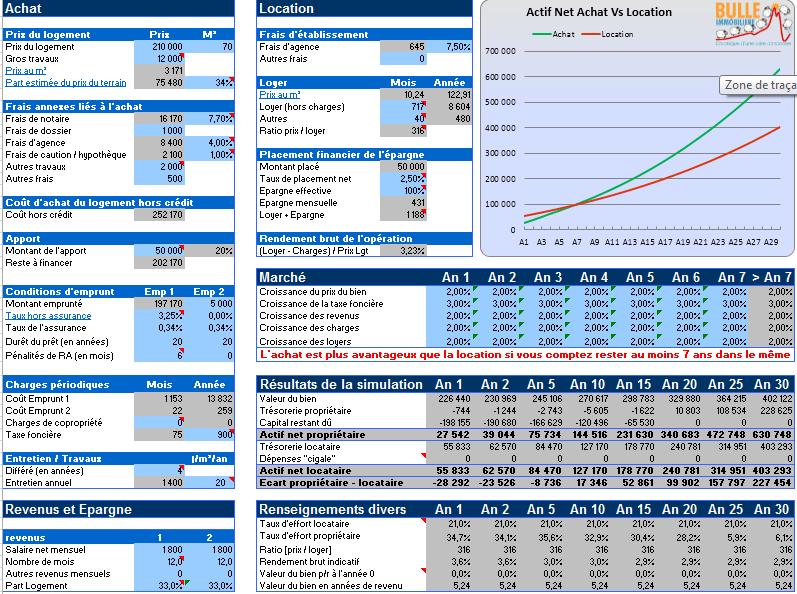

The comparator and broker in financial products Meilleurtaux.com recently presented its latest study “Buy or rent? to help French people choose between renting and buying their main residence. “If we consider the whole territory, the acquisition is profitable on average after 3 years and 5 months for a 70 m² (i.e. 1 year and 8 months more than in 2019 on average), indicates Meilleurtaux.com . Of the 36 cities studied, 4 cities, namely Caen, Clermont Ferrand, Metz, Nîmes, have seen the necessary holding period for a property decrease compared to last year”.

The increase in the length of detention required increases in Paris, Lyon, Montreuil, Boulogne Billancourt and Bordeaux. “In Paris, it takes 4 years and 8 months longer than in 2019 for the purchase of your main residence to be “economically interesting”, the same for Montreuil, it now takes 8 years and 5 months for your property to be more interesting to buy than to rent, whereas in 2019, it took 3 years, adds Meilleurtaux.com. But it is Lyon which has recorded the strongest progress, the city is seeing more than double the number of years necessary to achieve profitability, with 18 years against 7 years and 6 months in 2019, a phenomenon due to the sharp rise in prices recorded in this city which is experiencing the biggest change in France. However, this situation must be put into perspective with the fact that if we remove these 5 major French cities from this analysis (Paris, Lyon, Montreuil, Boulogne Billancourt and Bordeaux), the average drops to 1 year and 9 months to make its much more profitable to buy. »

If there are great disparities between certain cities, the purchase of real estate remains a real safe haven.

How long does it take to resell a property?

The question of the profitability of a real estate purchase can also concern a resale project. How long does it take to resell a property? The idea, to resell a property at a time when the purchase will have been profitable, is to absorb the costs inherent in the real estate transaction which are the notary fees. The latter represent 7 to 8% of the sale price in the old one and include a departmental tax (variable according to the departments but on average of 4.5%); a municipal tax (1.20%); Base costs (0.10%); the remuneration of the notary or proportional “emoluments”, ranging between 0.79% (for the portion above €60,000) and 3.870% (for the portion from 0 to €6,500); formalities fees; not to mention the costs of publication by the mortgage service.

“With a market increase of 3% per year, we have to wait at least 2 years to make it profitable and absorb this cost, estimates Dominique Charlemaine. But you will have to wait another year if you also have to integrate agency fees, and another to absorb the cost of potential work which was necessary in your eyes but which did not necessarily increase the intrinsic value of the property. For real estate located in a more sluggish market, the holding period is longer”.

Making a rental investment profitable: great disparities depending on the city

Concerning the rental investment, great disparities exist according to the cities. In Paris and the inner suburbs, for example, prices are high in terms of price/m2 ratio. Buyers buy expensive, and do not benefit from a very good profitability. "If you buy 150,000 or 180,000 a 15 m2 studio apartment, i.e. 10,000 euros/m2 or 12,000 euros/m2, and you rent it for 700 euros per month, it's a safe bet that the repayment of the loan to which in addition to the payment of property taxes and condominium works, will weigh more than what the real estate product itself brings in, in terms of rental profitability.

But with the increase in prices, products purchased 15 or 20 years ago have increased in value. On the Parisian market, we do not make rental profitability but land profitability, capital”.

In the provinces, in cities where real estate is much cheaper, the reasoning is different. “If you buy a 40 m2 2-room apartment in Pau for 70,000 euros, rent it for 450 euros, with a loan to repay of 300 or 320 euros, you will benefit from better rental profitability, explains Dominique Charlemaine. Money will certainly be generated every month or every year, but 10 years later, in a town that is not very dynamic, where the employment pool is not necessarily present, the property will be worth the same price”.

So choose the city where you will invest carefully, according to your objectives!

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game