How to calculate the real cost of a mortgage?

Real estate loansAnissa Duport-LevantiApr 17, 2021updated on Jan 14, 2022Share on

The real cost of a loan cannot be reduced to bank interest alone. There are a number of fees in addition to this interest and the return of capital. It is essential to take them into account when calculating the cost of your mortgage.

Calculate the total cost of the mortgage

Admittedly, real estate rates are close to their historic lows, sometimes with less than 1% for a loan over 15 years. Nevertheless, the mortgage has a cost, excluding monthly repayments of capital and interest. In addition to the notary fees (between 2 and 8% of the value of the property) which are not included in the sale price, there are administrative fees (around 1%), guarantees ( 2 to 3% of the amount borrowed) and borrower insurance (between less than 0.25% and more than 0.45% depending on the age of the insured, the amount and the duration of the loan). Example: a loan of 180,000 euros can cost more than 238,000 euros. But don't panic, most banking establishments have online simulators in order to properly calculate to borrow the amount necessary for your acquisition.

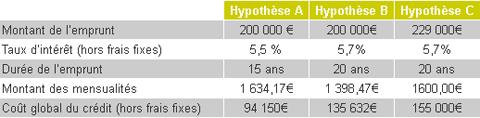

The key indicator to know is the annual percentage rate (APR). It allows you to know the real amount of your mortgage, by combining the borrowing rate, additional costs, guarantees and the cost of borrower's insurance, with the exception of notary fees. This APR is expressed as an annual percentage of the amount borrowed.

What are the application fees for a home loan?

These are the fees that your bank charges in return for the study and assembly of the loan file. They represent between 1 and 1.5% of the capital borrowed, according to the average observed by all players in the sector. This percentage may vary between banks and loan types. The application fees often have a minimum amount (generally around €500) regardless of the amount of the loan. More rarely, some banks also have a maximum amount (around €1,000) in order to avoid excessive costs for their customers. The administration fees are only required from the moment your loan application is accepted by the lending institution.

If you take out a regulated loan allowing home ownership, such as a zero-interest loan or an Action Logement loan, you will not have to pay administration fees on these loans. However, this exemption only concerns these credits. Thus, the administrative costs will apply to the classic mortgage to which you will couple these subsidized loans.

Guarantee fees: deposit, mortgage, IPPD

The guarantees of a mortgage guarantee the bank the payment of the monthly credit payments in the event of default by the borrower. Subscribing to a guarantee is compulsory. There are three types of home loan guarantees: surety, mortgage and lender's lien.

1. The bank guarantee

This is the most used guarantee. It consists of using a surety company, often affiliated with financial organizations and insurance companies, to protect against default. After three or four unpaid installments, the surety company pays the lender. At the same time, it approaches the borrower to find an amicable solution. If there is no outcome, the surety establishment can seize the property at the expense of the borrower, this is called a judicial mortgage. He can then proceed to sell it in order to reimburse himself.

The cost of a bank guarantee varies depending on the surety company. On average, surety fees include a commission, the amount of which can vary widely depending on the surety organization, and a contribution to the common guarantee fund which represents 0.8% of the amount of the loan, to which is added a lump sum of €200. The bank guarantee market is very heterogeneous and can vary from simple to triple, so be careful to compare the different offers. Indeed, the deposit is the only negotiable guarantee and banks often work with preferred guarantee organizations in order to offer you competitive rates.

2. The mortgage

This other guarantee solution is executed before a notary and is published in the Land Registry Service. It allows the bank to seize the mortgaged property in the event of default. The mortgage requires paying the application fees, in addition to those of the credit, which amount to around 1.5 to 2% of the total amount of the mortgage. Thus, the higher the loan, the more expensive this guarantee solution will be.

3. The registration in privilege of lender of funds (PPD or IPPD)

This guarantee must be recorded in a notarial deed. One can only register in privilege lender of money an already existing property, therefore already built or a land to be built. The banking establishment has a lien on the property which gives it priority over all other creditors in the event of non-reimbursement of the mortgage.

"The IPPD is subject to the emoluments of the notary, the real estate security contribution, the registration fees and the VAT (for new constructions completed), but not the land registration tax, which amounts to approximately 0 60% of the total amount of the loan”

Superior Council of Notaries

Don't forget the borrower's insurance!

Although it is not legally obligatory, in the case of a mortgage, a banking institution will always ask you to take out borrower insurance, which protects both the lender and the borrower in the event of an accident in life. thanks to various guarantees. Its cost varies according to the age, the state of health or the profession of the person who borrows. Mortgage loan insurance does not have to be taken out within your lending institution, but the latter will be more likely to offer you a favorable rate if you subscribe to its group insurance. You can then change insurance if you wish each year on the anniversary date of the loan, but this operation will entail additional additional costs.

Application fees, guarantee fees, loan insurance… after having studied all these additional costs that surround the mortgage loan, you should avoid unpleasant surprises and have an idea of the overall effective rate of your credit by opting for the most efficient solutions. profitable according to your profile.

Share onMore adviceborrower mortgage purchase real estateFrench

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game