Inflation premium: the method of payment by the employer

This exceptional and individualized assistance of € 100, more commonly known as "Prime Inflation", is paid to anyone aged at least 16 years old regularly residing in France, that their resources, appreciated with regard to their situation, make it particularly vulnerable to theIncrease in the cost of living scheduled for the last quarter of 2021. It is subject to a single payment to each beneficiary.It is unlistible and elusive.In addition to employees, the self -employed workers, job seekers, retirees who earn less than € 2,000 net per month.

Employer's unilateral decision -making model (due) - Exceptional purchasing bonusPassez à l’action :Employer's unilateral decision -making model (due) - Exceptional purchasing bonus

Established by article 13 of the second amending finance law for 2021, published in the Official Journal of December 2, the Prime Inflation had already been the subject of numerous comments before the final vote of the text.As of November 9, the URSSAF published a fair for questions on its website, then the GIP-MDS detailed the declarative terms of the Prime Inflation in an update of the DSN file, accessible on the Net-Entreprises site.Fr.

On December 2, the Official Social Security Bulletin (BOSS) disseminated, on its website, a "question and answer" dedicated to the conditions and terms of payment of the Prime Inflation.A decree of December 11 has just fixed, lastly, the conditions and terms of payment of exceptional aid of € 100, specifying in particular the payment calendar.

Read also Prime Inflation: the self -employed will benefit from an automatic payment

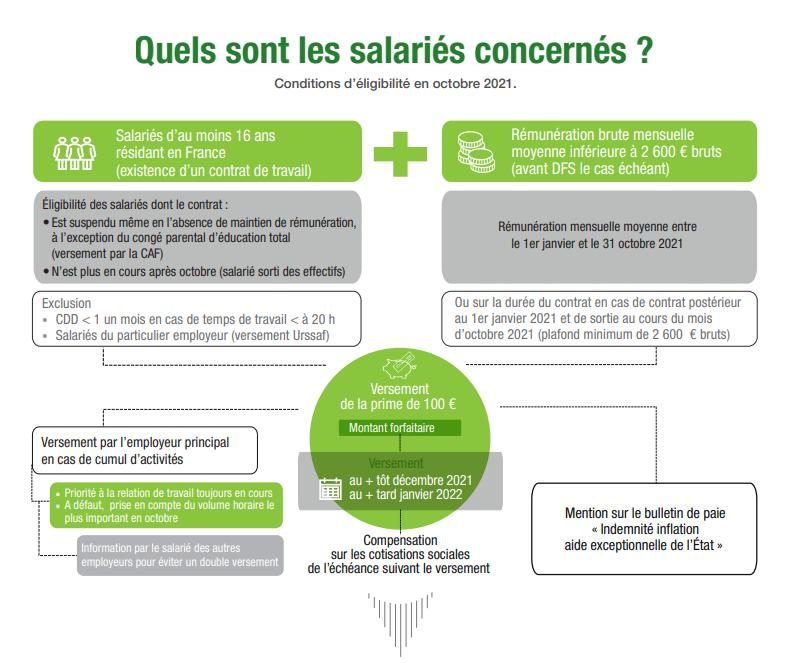

What are the conditions of eligibility for the inflation premium?

Age condition: be at least 16 years old

A minimum age is required to benefit from the inflation compensation: to be at least 16 years old on October 31, 2021.

This makes it possible among beneficiaries all young people in activity or enrolled in a training or support process towards professional integration, such as alternating young people, vocational training trainees or young people in civic service.

Activity condition: be employed in October 2021

The aid is paid by the employer to the employees provided that they were employed during the month of October 2021 (even if they have left the company since).

Condition of remuneration: win less than € 2,000 net per month

Les salariés qui ont perçu, au titre de la période courant du 1er janvier au 31 octobre 2021, une rémunération inférieure à 26 000 € bruts bénéficient de la prime inflation (soit 2 600 € brut par mois en moyenne sur la période, ce qui correspond à 2 000 € net par mois avant impôt sur le revenu).

Note: The reference period retained makes it possible to avoid taking into account the payment of 13th month and end -of -year bonus which could lead to exclude certain employees from the measurement field.

Attention !The aid is individualized, only the beneficiary's income is taken into account, without consideration of all the resources of the household.

It is not taken into account to assess this income ceiling, ducts practiced on remuneration for lump sum deductions for professional costs, as well as allowances paid to the insured by a paid leave fund.

Note: When the contributions are calculated on flat -rate bases, the remuneration taken into account for the appreciation of the ceiling of € 26,000 corresponds to these flat -rate bases.

Pour les salariés qui n’ont pas été employés pendant toute la période courant du 1er janvier au 31 octobre 2021, le plafond de 26 000 € de rémunération est réduit à due proportion de la période non travaillée, sans pouvoir être inférieur à 2 600 € bruts, selon la formule suivante : (nombre de jours de la relation de travail/nombre de jours calendaires de la période de référence) × 26 000 €.

On the other hand, this ceiling is not proratized at the rate of the occupation of a part -time or unpleasant time job.

Note: any salary elements after the employment period are not retained, whether it may be the cause, apart from the cases of payroll.

Special regimesFor freelancers, the remuneration taken into account is the sum of the remuneration collected as the rods made for the main employer on the entire reference period.For intermittent contracts, the ceiling is adapted according to the total duration of the intermittent contract and not according to the number of days actually worked on this period. |

Residence condition: be a French resident

To claim inflation compensation, a condition of residence in France is required.

Are thus eligible, the employees residing in metropolitan France and in the drom-coms of Guadeloupe, Guyana, Martinique, Reunion, Saint-Barthélemy and Saint-Martin.The employees of Mayotte and Saint-Pierre-et-Miquelon are also eligible for the system.

With regard to the assessment of this condition of residence, employees are eligible for whom the employer applies the deduction from the source of income tax (PAS) and who are liable for the CSG on their income fromActivity, a criterion appreciated over the month of October 2021. Respect for this criterion on a part of October is sufficient.

Read also the Solidarity Fund for October 2020 to October 2021

Who are the beneficiaries of the Prime Inflation?

In practice, with regard to employees in the private sector, the compensation is paid to them provided that they meet these age and residence conditions, that they were employed during the month of October 2021 (even S'They have left the company since) and that they do not exceed the resource threshold.

Employees on fixed -term contracts

An employee on fixed -term contracts can claim the inflation premium, regardless of the duration of his contract during the period of January 1 to October 31, 2021.

Examples: an employee with a contract starting on September 1, 2021 and ending on October 15, 2021 is eligible, just like the one whose employment contract begins on October 18 and ends on October 22.On the other hand, the employee holding a CDD from January 1 to September 24, 2021 is not entitled to compensation.

Former employees

Even if the employment contract is broken, the employer for which the employee worked in October 2021 must pay him the compensation under the same conditions as for other employees.The employer must also pay the compensation to former employees to which he paid in October 2021 a business pre -retirement allowance (even when the employment contract is broken).

Note: the absences, remunerated or not, of the employee during the month of October are without impact on the benefit of the compensation

Absent employees

Even if the employee is absent during all or part of October 2021, regardless of the reason for this absence, the employer must pay him the compensation under the same conditions as for other employees.

Disabled workers

Handicapped workers benefiting from a work support and assistance contract benefit from compensation under the same conditions as other employees.

Remained corporate agents

Social agents not holding an employment contract (minority managers of SARL, the managers of SAS or SA) receive compensation from the company which pays them remuneration for this corporate mandate for the month of October2021.

Alternating and trainees

Students and students in training in a professional or internship receive the employer's compensation with which they are bound by an internship agreement, during the month of October 2021, as soon as it pays them an amount ofgreater gratuity greater than minimum legal gratuity.

Note: The legislator requires the compulsory payment of a gratuity for all business internships for more than two consecutive months or, during the same school or university year, more than two consecutive months or not.Below this duration, the payment of a gratuity remains optional.In the absence of an extensive branch or professional agreement agreement providing for a more favorable gratuity amount, the trainee must receive, by working hour, a gratuity at least equal to 15 % of the hourly social security ceiling.

Employees excluded from payment by the employerAre however excluded: |

READ ALSO PASS Sanitary, instructions for use

What is the amount of the inflation premium?

The amount of the inflation compensation is, in all cases, equal to € 100 per beneficiary.

It is not reduced according to the duration of the employment contract, nor according to the working hours provided for in the contract.

Read also PLFSS 2022: the social measures adopted in final reading

What are its terms of payment of the premium by the employer?

At the expense of the State, the inflation premium is paid to employees by their employer who employed them during the month of October 2021. In practice, the employer pays the inflation allowance to its employees in December 2021 and,Unless practical impossibility, no later than February 28, 2022.

It is registered on a dedicated line of the pay slip under the wording "Inflation allowance - Exceptional state aid".

Read also initiative France: they created their business despite the crisis

A principle: an automatic payment of the inflation premium by the employer

The employer must automatically pay the inflation compensation to employees fulfilling the conditions of eligibility (age, residence and income condition) and employee on permanent contracts or fixed -term contracts of one month, underOne or more contracts whose cumulative duration reaches at least 20 hours during the month of October 2021 or, when contracts do not provide for time time, at least 3 days.

The aid is also automatically paid by employers to their former employees to whom they paid, in October 2021, the advantages of pre -retirement.

Exceptions: Payment only on request for certain employees

The payment of the inflation compensation will be made at the request of the employee eligible to his employer for:

Attention !The two conditions being cumulative, if the CDD is less than one month but for which 22 hours were carried out in October, the payment of the compensation is automatic.Ditto for a fixed -term contract of at least a month but for which 12 hours were done in October.

Read also companies' procedures: Kbis is over

Several special cases: multi-employee employees or exercising other activities

When the employee is also likely to benefit from the compensation paid by an organization (URSSAF, CAF, etc.) under an independent activity, a corporate mandate or another form of activity, he mustInform the employers (s) likely to pay him this compensation so that they do not proceed to this payment.

In this case are, employees who have carried out a self -employed activity in October 2021, employees of individual employers who are also employed by a classic employer and employees on full -time education leave.

In addition, as soon as an employee considers that he is not eligible for the system, he must inform his employer (s) so that the latter (these) does not proceed to the payment of thecompensation.

Finally, if multi-employment employees whose cumulative working hours exceeds 20 hours in October can claim the automatic payment of inflation compensation with several employers, they can only receive one compensation.They must therefore identify the employer who must pay them the compensation according to the following priority rules:

Then, the employee must notify other employers not to pay them the compensation.

These provisions apply under the same conditions to corporate agents when they can benefit from aid for several mandates.

Please note! The employer cannot be held responsible for paying aid to an employee who does not meet the conditions of eligibility or who would also be eligible for another title when the employee did not inform him of his situation.

Read also health protocol: the rules applicable in business are strengthened

Should the employer inform his employees?

The employer is required to set a reporting period to be respected by all its employees (and his ex-employees who worked in the company in October 2021 but who have left him since) of an element that would deprive them toAn automatic payment of the inflation premium by the employer or would force them to stop the payment with his or his employers.

In the absence of an employee's response within the time limit, the employer must pay the compensation and is not then held responsible for the double payment.

Read also professional risks: employers must declare their employees before January 5 or 15, 2022

February 28, 2022, deadline for payment of the inflation premium

The inflation premium must be paid by the employer from December 2021 and at the latest on February 28, 2022.

People who have not benefited from the payment of assistance to February 28 will be able to ask the employer. The employer is then required to pay the aid, after verification of the eligibility, within 30 daysfrom the request.

Note: Companies practicing the payroll of the pay can pay the compensation in December with the pay of November, in January with the pay of December or, at the latest, in February with the pay of January.

DSN procedureAid employers declare the premiums paid in the same ways as the remuneration they pay through the DSN.The inflation premium follows the payroll rules (employment period) with which it is paid. It can therefore be declared in DSN no later than January 5 or 15, 2022 for a payment with the pay of December 2021. The declarative terms of the inflation in DSN are detailed by the GIP-MDS on the Net-entreprises.fr site in file n ° 2534. |

Pay your social security contributions

What are the methods of compensation for the employer?

Employers will benefit from an integral reimbursement of the amount of the inflation compensation paid, by imputation of the amounts paid on the social contributions due to the recovery organization which they raise (URSSAF or MSA) as soon as the nearest payment maturityDepending on the payment of the aid, after applying any other total or partial exemption.

If the amount of the compensation exceeds the amount of contributions due to the recovery organizations, the share exceeding the social contributions due will be deducted from the sums due for the following deadlines or will give rise to a reimbursement in favor of the employer.

Watch out for URSSAF controls!URSSAF checks may take place in order to verify that the sums deducted from social security contributions by employers do not exceed aid paid to eligible employees.Any breach noted by URSSAF controllers will give rise to a payment request. |

What is the social and tax regime for the employee?

The inflation compensation is completely exempt from social and conventional social contributions and contributions of income and income tax.

Note: In order to prevent the payment of the Prime Inflation from leaving to withdraw the benefit of social minima from people who are beneficiaries, exceptional aid will not be taken into account for the calculation of income and resources giving entitlement to allowances, contributory or non -contributory benefits and advantages, nor to determine their amount when the law is open.

The consequences of a breach or an error for the employer

Aid unduly received, especially when the beneficiaries have received several payments from different debtors, are donated directly by their beneficiary to the State.

They can also be recovered according to the rules and procedures applicable in matters of claims foreign to tax and the field.

Read also the salary entry

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game