Correction of real estate prices in 2022 |Lesaffaires.com

"The chalet market delivery which has been bought for investment purposes with unrealistic financial projections could participate in increasing the number of boards of this type of property in the next two years," according to Charles Brant,Director of the market analysis department of the Professional Association of Real Estate Brokers of Quebec (APCIQ).(Photo: birgit loit for unsplash)

Guest blog.Following the market overheating period, some sectors will inevitably undergo price corrections.

With the pandemic, several people have left the big centers and increased the sales and prices of the main and secondary residences outside these centers.With frequent bidding, people had to buy their property at a price higher than the true value of the building.

Several "exiles" will return to work full or partial and will want to get closer to their workplace again.If they wish to sell their property, we risk seeing price corrections in certain sectors.This is more likely in smaller centers, relatively far from the workplace and less in demand.

This is at least what Charles Brant, director of the market analysis department of the Professional Association of Real Estate Association of Quebec (APCIQ) believes."I think there will be corrections in markets that are peripheral to urban areas, in particular, the properties where proximity to services is less good or access to public transport is more difficult," he says.All properties have benefited from this somewhat irrational craze for houses on the outskirts and I think they will be the first to see their price be corrected.Telework will not remain as it is right now.The proximity of the workplace will still be important.There are also people who have gone in the campaign and who are not made for that.»»

Decrease in the number of buildings for sale

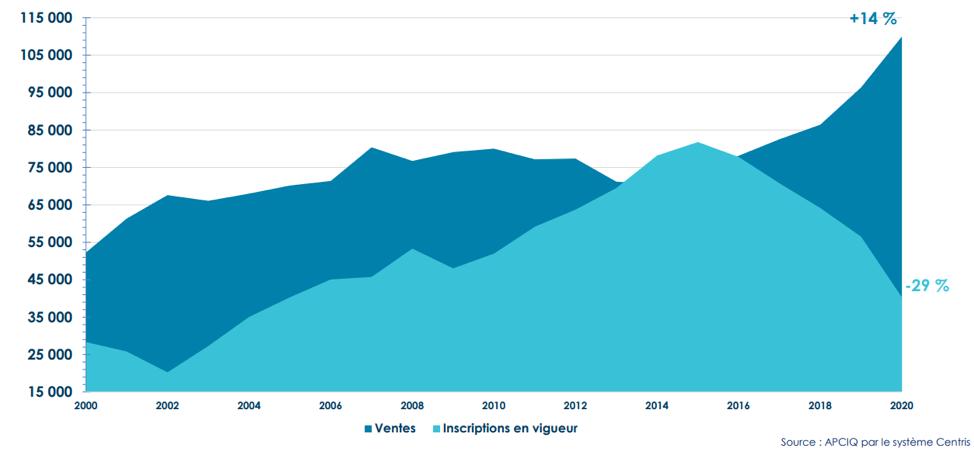

If you have the impression that the drop in registrations (buildings for sale) has been down recently, think again.The number of buildings for sale has been declining for six years.However, the drop in 2020 was 29%, a record level.APCIQ has prepared this interesting graphic.We see the prices and the number of registrations in force on Centris, for all of Quebec.This drop is generally observed almost everywhere and for all categories of properties.Does the drop in supply increase prices?Yes, as the graph clearly demonstrates.The less registration, the more bidder there are.

CLIQUEZ POUR AGRANDIR l'IMAGENot enough new constructions

Another factor explaining the low level of supply is that historically, the level of new constructions was low.However, 2021 is a record year.Between 40,000 and 60,000 dwellings in Quebec would be missing, according to APCHQ.The latter mentions long deadlines to obtain permits, zoning regulations and the shortage and high costs of materials as well as brakes.

No generalized price decrease

According to several economists, a moderate rise in the inventory of properties for sale should occur in the coming quarters.This will have a relatively low impact.As soon as we have passed the fourth wave, an increasing number of people who have delayed their intention to sell will be tempted to sell at a high price.Government aid will fade.People may no longer be able to pay their mortgage.

Several other factors are favorable to an increase in prices.We are not expecting significant increase in interest rates in 2021 and 2022.The unemployment rate is low. Tous les partis politiques fédéraux veulent encourager l’« abordabilité»» et ont des programmes pour augmenter la demande.

Although we perceive a slight trend towards balance, the vast majority of markets will remain selling markets.Prices will not drop in 2022, but increases will be more moderate than in 2020.

What buildings are the most likely to undergo a correction?It's not complicated.Some buildings have been purchased at a high price.Several of these buildings will be put up for sale.The purchase price will be determined by buyers and it may be lower for certain markets.

"The health restrictions imposed due to the Pandemic of COVVI-19 prompted several to want to move away from major centers and acquire greater property since home work is now part of their daily life, specifies Charles Brant.Some households have bought properties at prices really higher than their real value, even if they are far from services and high roads.In the longer term, with market normalization, these properties could be more at risk of correction.»»

« La remise sur le marché de chalets qui ont été achetés à des fins d’investissements avec des projections financières irréalistes (dans un contexte où la situation sanitaire est vouée à s’améliorer significativement, favorisant les voyages) pourrait participer à augmenter le nombre de mises en marché de ce type de propriétés au cours des deux prochaines années»», ajoute le directeur du département d’analyse de l’APCIQ.

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game