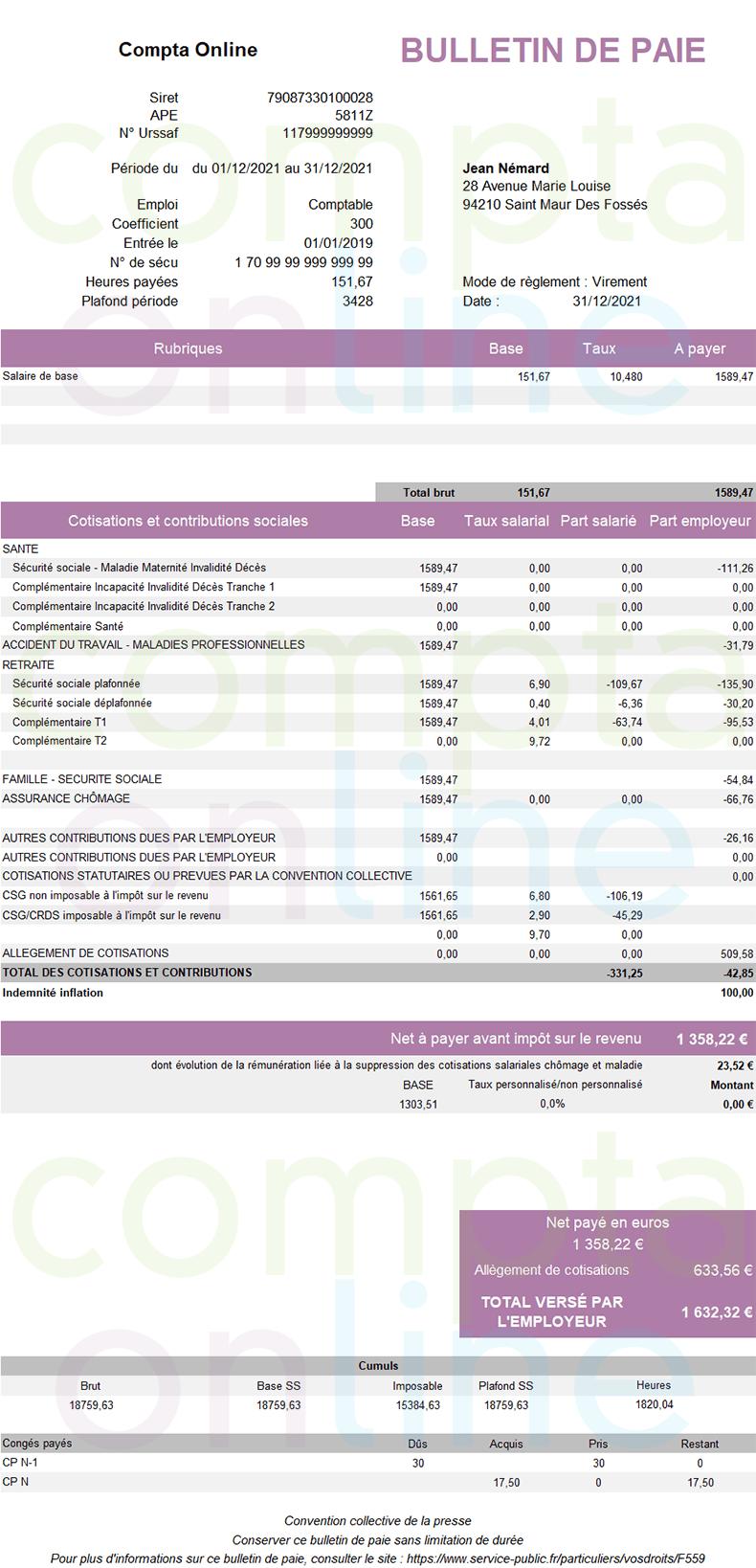

Inflation compensation on the employee's pay sheet

The inflation allowance must be paid by employers and appear on the December pay sheet.Depending on the pay software, it can appear at the top or bottom of the pay sheet.

In both cases, it will be completely exempt from social security contributions and income tax.

The inflation allowance was implemented by the amending finance law for 2021, published in the Official Journal of December 2, 2021.A question-answer already provides additional answers and decree n ° 2021-1623 was published in the Official Journal.

It is published on the website of the Official Social Security Bulletin (BOSS) and supplemented by a DSN file for the terms of declaration of this section in DSN.

Employers who pay the inflation allowance will be reimbursed when paying social security contributions via the DSN.

Who pays the inflation allowance?

The inflation indemnity is paid by the employer or by certain other organizations such as URSSAF for individual employers or training organizations for trainees in vocational training not holding an employment contract.For employees on full -time education parental leave, the compensation is paid by CAF.

Consequences of the inflation compensation on the employee's pay sheet

Inflation and beneficiary employees

The inflation compensation of € 100 must be paid to eligible employees (aged at least 16 years old on October 31, 2021) who reside in metropolitan territory and in certain DROM-Coms.

To benefit from it, the employee must have been employed for an indefinite duration or a minimum duration of one month, as one or more contracts whose cumulative duration reaches at least twenty hoursDuring the month of October 2021 or, when contracts do not provide for time time, at least three days.

Trainees linked to an employer by an internship agreement during the month of October 2021 which receive remuneration greater than minimum gratuity and corporate agents not holding an employment contract are also affected under conditions.

Finally, periods of suspension of the employment contract such as the disease are not taken into account except for parental full -time education leave.For the latter employee, the compensation is paid by another organization.

To benefit from the compensation, the employee must receive net remuneration for less than € 2,000 per month, or a maximum of € 26,000 gross for the period from January to October.Package abatements for professional expenses are not taken into account as well as replacement income or partial activity allowances.

The € 26,000 ceiling is adjusted in proportion to the duration of the contract in 2021, but not for part -time employees.

Inflation compensation will be paid in December 2021 unless practical impossibility.In this case, it is paid no later than February 28, 2022.

What salary is taken into account for inflation allowance?

The salary to be taken into account for the inflation compensation ceiling is made up of all the remuneration subject to social contributions within the meaning of article L242-1 of the Social Security Code.These are activity income excluding replacement income and excluding partial activity allowances.

Inflation and DSN compensation

The information relating to the declaration of the inflation in DSN is given by the DSN 2534 sheet entitled "Declarational methods of the inflation in DSN".

This DSN sheet specifies in particular that:

Inflation allowance and pay sheet

The inflation indemnity must appear on a separate line of the pay slip of the employees concerned.

The title of the section will be "inflation allowance - exceptional state aid" or simply "inflation compensation".

Example

An employee in the minimum wage receives the inflation allowance of € 100.Payroll software places compensation at the bottom of the pay sheet.

Find out how to remove the tartar on your dog's teeth

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!

What are the measures in the dart game