What are the differences between a relay loan and a purchase/resale loan?

Relay, purchase-revenue: what are the different operations?

Whether it is for a relay credit or a purchase-meeting, the same backdrop stands: these are two possible financing solutions when you want to buy a new apartment in the new one before having sold your accommodationcurrent.

ive been learning myself how to cook better in recent months and ive gained 3 nuggets of wisdom in this time: - yo… https://t.CO/9CIQZHTHAK

— Abby Rauscher 💀🏳️🌈 Wed Mar 31 00:36:33 +0000 2021

Relais credit is the "classic", "historic" solution, while the purchase-revente loan only appeared in 2014.

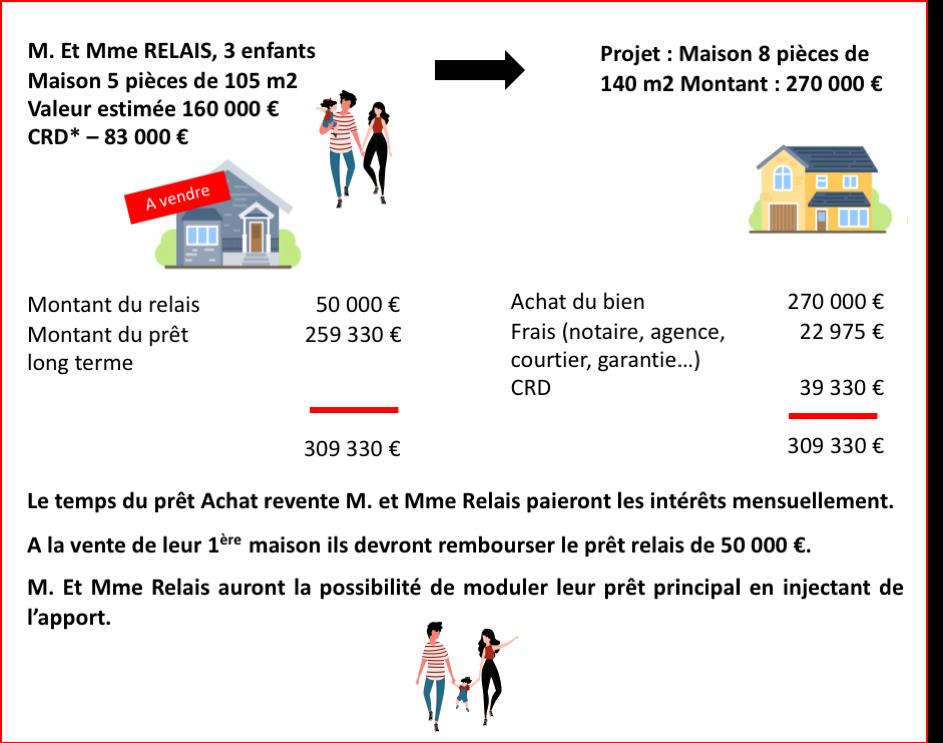

On the operation side, the relay credit allows you to borrow up to 70% of the value of the property you want to resell, after deduction from the rest of the mortgage that you have to pay - if that is the case.By subscribing to a relay credit, you accumulate your old credit, the relay credit and potentially a supplementary loan if your contribution is not substantial enough.The relay credit actually allows you to finance your new accommodation while taking advantage of 1 to 2 years to resell your old property at a good price.Then, the relay credit will be absorbed by the sale of your old property.

Purchase credit has the same operating mode as the relay credit.You get an advance from the bank, ahead which will be reimbursed by the sale of your old property.However, the resale purchase loan will have the advantage of gathering all your credits in one.

Find out how to remove the tartar on your dog's teeth

Quels Accessoires Connectés Huawei Sont en Promotion pour ce Black Friday?

Under what conditions can you have an inflatable jacuzzi on its terrace or balcony?

Grass mower a perfect lawn!